The formula for the operating expense can be derived by using the following steps. In practice accretion expense is commonly recognized in relation to an asset retirement obligation AROs.

Fixed And Variable Expenses Tomball Elementary

In other wordsand this is the pivot pointit will cost no additional dollars on any of the following items to take those last 10 rooms.

. Thus a laptop computer could be considered a fixed asset as long as its cost exceeds the capitalization limit. A debit to COGS - expense account A credit to Inventory - asset account. Additional items within the lease agreement that need to be factored into the straight-line lease expense calculation may include the following.

This expense is recognized as an operating expense in the statement of income. Account for Repair and Maintenance. Approved claims paid in 24 hours.

Cost is an investment towards the purchase of assets for the future benefits of the business. Simple one-page application makes the process easy. Examples of Fixed Assets.

Final expense benefits available up to 35000. This initiative was first introduced in the Year of Assessment YA 2019 for Private Hire Car PHC Taxi drivers. Nightingale murmured a room number and motioned down a hall crowded with bodies like the day after Gettysburg while white-coated figures strolled among the moaning clip boards in hand With wide-eyed Fred following behind Dean ran the gauntlet until he found the room a small office packed with five men and a lot of smoke three of them in Philadelphia Police uniforms.

This might include direct indirect production operating distribution charges incurred for business operations. All the costs for the following under this scenario are fixed. Many fixed assets are portable enough to be routinely shifted within a companys premises or entirely off the premises.

Indirect project costs are those that arent linked to the project. An ARO is a liability established for the removal of fixed assets such as property equipment or leasehold improvements at the termination of the lease. Rent expense for calculation purposes is a type of fixed expense as opposed to a variable expense.

Note that direct costs can be fixed or variable. Fixed Expense Deduction Ratio FEDR To simplify tax filing and ease the burden of record keeping qualifying taxpayers can elect to deduct a deemed amount of expense based on a prescribed percentage of the gross income earned. Form 4952 is an IRS tax form determining the investment interest expense that may be either deducted or carried forward to a future tax year.

Overview During the ordinary course of business there are certain routine expenses that are considered unavoidable. COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor cost and. The utilities expense is based on the amount used during an accounting period and is included as part of operating expenses in the income statement of the business.

They are part and parcel of the operations of the company and therefore need to be paid by the company in order to ensure that there are no bottlenecks that hinder the performance of the company. For example a spool of filament - which is used as part of my printing service but also as. They are important as.

Firstly determine the COGS of the subject company during the given period. Projects cost money and therefore demand project expense tracking. We are already running a house count of 285 rooms and occupancy of 966 percent.

If any from the sale are higher than the carrying amount of the asset at the time of disposal. At the same time the expense is on the ongoing business for revenue generation. 1 What journal entries are required if I need to convert an item originally classified as inventory into a business supply.

These expenses still must be paid. Every Funeral Advantage policy from Lincoln Heritage features the following. Cost is a one-time payment in nature while expense is a regular payment.

I also record the following. No medical exam is needed to apply for coverage just a few health questions on the application. Useful life of more than one year.

Cost Incurred Incurred Cost refers to an expense that a Company needs to pay in exchange for the usage of a service product or asset. Read more to market the companys product on social media or tv channels. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation from balance sheet recording receipt of cash and recognizing any resulting gain or loss in income statement.

Cost of 500 or more. As an expense rent is normally a debit balance account recorded on the income statement. The fixed expenses in this hotel at this point are many.

The Organization records fixed assets meeting the following criteria to the Property Equipment account using a detailed description. A fixed asset does not actually have to be fixed in that it cannot be moved. I have two questions.

Depending on the size of the utility bill a business might maintain separate general ledger accounts for each utility or combine them into one utilities expense account. The Executive Director annually does an inventory of fixed assets updating records for disposals or impairment. The following equation.

The balance sheet usually reflects Cost while expense forms part of the profit and loss statement. Being able to manage and track expenses is what keeps the project within a budget.

Fixed Costs Business Literacy Institute Financial Intelligence

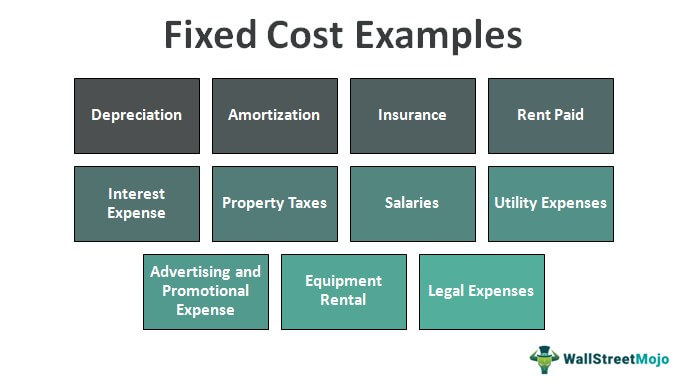

Fixed Cost Examples Top 11 Examples Of Fixed Cost With Explanation

Do You Know The Difference Between Fixed Vs Variable Costs

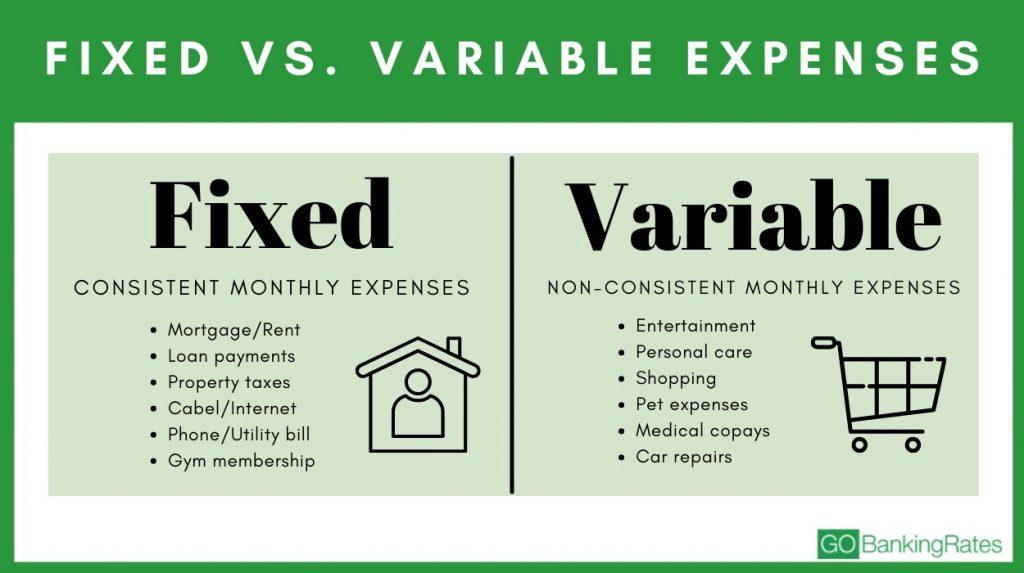

Fixed Expenses Vs Variable Expenses For Budgeting What S The Difference Gobankingrates

0 Comments